As part of the Presidential Palliative Programme, the Federal Government of Nigeria has introduced two initiatives aimed at mitigating the impact of fuel subsidy removal: the Presidential Conditional Grant Programme and the Presidential Palliative Loan Programme.

This announcement came through a recent press release by the Honourable Minister for Industry, Trade, and Investment, Dr. Doris Uzoka-Anite, CFA.

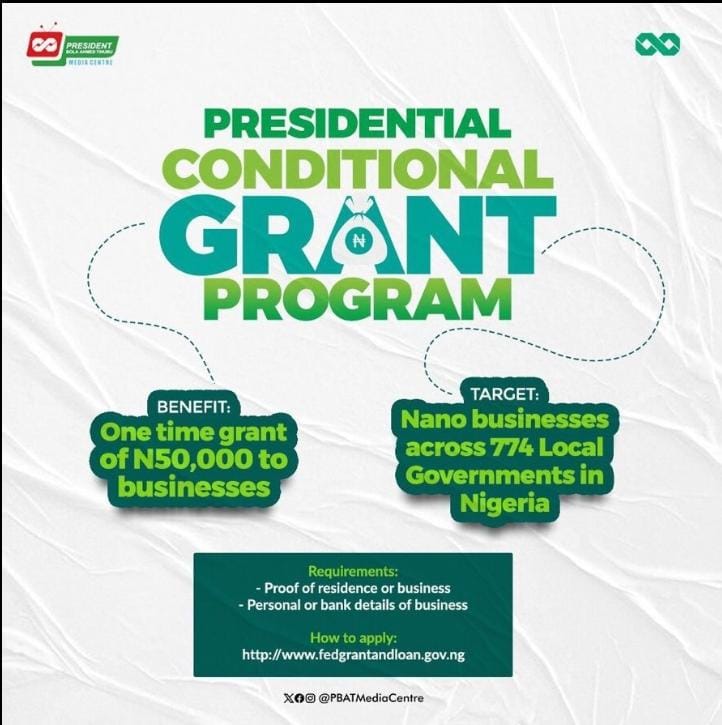

Under the Presidential Conditional Grant Programme, the Federal Government plans to distribute a grant of N50,000.00 (Fifty Thousand Naira) to nano businesses across all 774 local government areas in the country.

To implement these programs effectively, the Federal Government, in collaboration with the Federal Ministry of Industry, Trade, and Investment and the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), will engage with State and Local Governments, Federal Legislators, Federal Ministers, Banks, and other stakeholders.

According to the statement, eligible nano business beneficiaries should be willing to provide proof of residential/business address in their local government area, and provide relevant personal and bank account information, including Bank Verification Number (BVN) for verification of identity.

For the Presidential Palliative Loan Programme, the Federal Government will likewise disburse N75 billion to Micro, Small and Medium-sized Enterprises (MSMEs) across various sectors and N75 billion specifically to Manufacturers. The loan shall be administered to the beneficiaries at a single-digit interest rate of 9% per annum.

While MSMEs can access loan facilities up to N1 million with a repayment period of three years, manufacturers can access up to N1 billion to access financing for working capital with a repayment period of 1 year for working capital or five years for the purchase of machinery and equipment.

MSMEs and manufacturers can apply for the loans by submitting their application on the portal provided for the programme. The facility would be accessed through their banks, and applicants would be required to meet the risk assessment criteria of their respective banks.

As part of its commitment to promote economic development, entrepreneurship and financial empowerment, the Federal Government believes these initiatives will encourage entrepreneurship and job creation.