IgbereTV had reported that The Nigerian National Petroleum Company Limited on Wednesday secured an emergency 3 Billion Dollar loan from the AFREXIM Bank to help stabilize the Naira.

Below are 8 Important Facts you need to know as explained by O’tega Ogra and Opeolowa.

1. What is the $3 billion loan about?

The NNPC Ltd. secured an emergency $3 billion crude oil repayment loan from AFREXIM Bank. This is not a crude-for-refined products swap but an upfront cash loan against proceeds from a limited amount of future crude oil production.

2. Is this loan risky for NNPC Ltd. or the Nigerian Treasury?

No. The exposure for NNPC Ltd. is very limited, covering just a fraction of their entitlements. Additionally, there are no sovereign guarantees tied to this loan.

3. What’s the benefit of this loan to Nigeria?

The loan will assist NNPC Ltd. in settling taxes and royalties in advance. It will also equip the Federal Government with the necessary dollar liquidity to stabilize the Naira, with limited risk.

4. How will the loan be disbursed?

The funds will be released in stages or tranches based on the specific needs and requirements of the Federal Government.

5. Will this affect fuel prices?

A strengthened Naira as a result of this initiative will lead to a reduction in fuel costs. This means that if the Naira appreciates in value, the cost of fuel will drop and further increases will be halted.

6. What about subsidies? Are they coming back?

No. A stronger Naira will result in lower prices from the current level, making subsidies unnecessary. The deregulation policy remains unchanged.

7. How will the loan be repaid?

The loan will be repaid against a fraction of proceeds from future crude oil production. It’s a strategic move that ensures a balance between our current economic needs and future production capabilities.

8. What is the difference between this and previous swap deals?

This is not a crude for refined products agreement where the government does not earn any proceeds from the swap.

OPEOLUWA also explains:

This is great news. This is a form of Volumetric Production Payment (VPP). It is a structured investment that involves the owner of an oil or gas interest ( Nigeria/ NNPC) borrowing money( $3 billion) against a specific volume of production of crude oil. The investor or lender (Afrexim bank) receives a stated monthly quota of crude oil often in raw output, which is then marketed by the VPP buyer( Afrexim ). Buyers could include investment banks, hedge funds, energy companies, and insurance companies.

Simply put, Afrexim is borrowing us $3 billion which will be used to help stabilize the naira in exchange for a daily quota of our crude oil production.

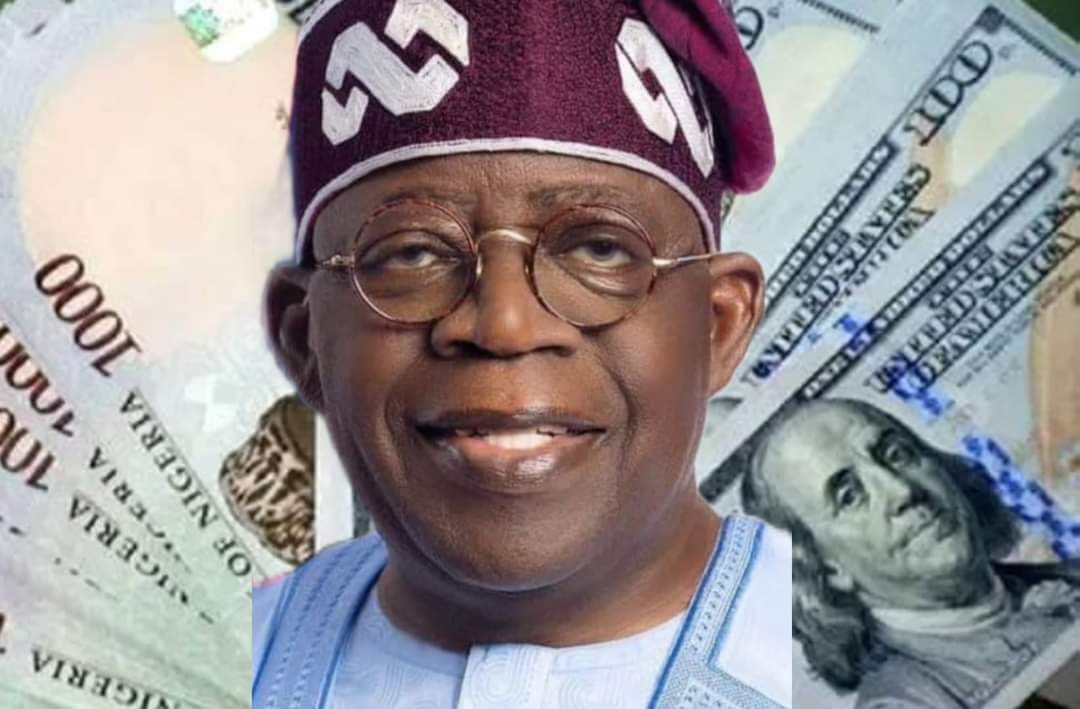

This is part of PBAT’s fiscal ideology he talked about in his article in 2015: “Oil is a passive asset in the ground. When cash-strapped yet in need of more revenue presently, a nation should also consider issuing guarantees on the future oil shipments on a price certain paid now; or selling a portion of its equity in the joint ventures.

Some may call this a variant of an oil futures. Whatever it is called, it should be considered particularly as a measure to improve our foreign currency position.”

For the first time we have a president with an ideology and he seem to be following through on his ideologies.

Stay with IgbereTV, Africa’s number one online community TV