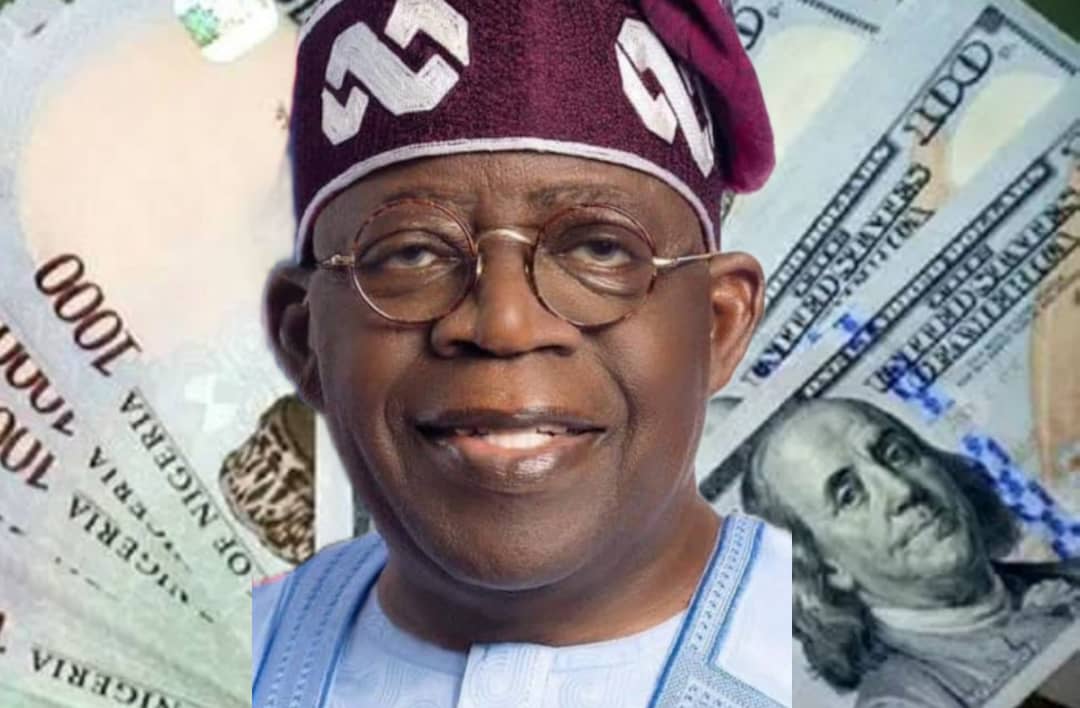

Less than two months into his administration, President Bola Ahmed Tinubu has repaid a $500 Million Eurobond Loan borrowed by the Goodluck Jonathan administration in 2013.

IgbereTV understands that the bond was issued as part of a dual-tranche $1bn Eurobond with a tenor of 10 years and a coupon of 6.375% per annum.

A statement by the Debt Management office obtained by IgbereTV said this is the third Eurobond that Nigeria has repaid in the past six years, following the repayments of $500m in July 2018 and $500m in January 2021.

It should be noted that currently, the country’s total debt stock is estimated to be around $103bn.

The statement reads in full.

“Nigeria Re-Affirms Its Commitment To Meeting Its Debt Service Obligations As It Redeems A USD500 Million Eurobond On Its Due Date On July 12, 2023.

“The Eurobond was issued in July 2013 (as part of a dual-tranche USD1 billion Eurobond) for a tenor of ten (10) years at a coupon of 6.375% per annum.

“Nigeria had previously redeemed a USD500 million Eurobond in July 2018, another USD500 million Eurobond in January 2021, and a USD300 million Diaspora Bond in June 2022. These, together with the USD500 million Eurobond redeemed today, bring the total amount of securities redeemed by Nigeria in the International Capital Market (ICM) to USD1.8 billion.

“Nigeria’s successful redemption of its Eurobonds and Diaspora Bond in the ICM over the past six (6) years is a demonstration of its strong debt management operations and planning.

Meanwhile, below is the Naira exchange rates to major currencies (Dollar, Euro and Pounds) in the black (parallel) markets in Lagos, Abuja and Kano this morning Thursday July 13, 2023.

Dollars to Naira (USD to NGN) Exchange Rate Today

Buying Rate 815

Selling Rate 801

Euro to Naira (EUR to NGN) Exchange Rate Today

Buying Rate 880

Selling Rate 860

Pounds to Naira (GBP to NGN) Exchange Rate Today

Buying Rate 1040

Selling Rate 1020

Stay with IgbereTV, Africa’s number one online community TV