Dangote has openly said that the price differential between his exporting cement and what Nigerians pay domestically is primarily caused by Nigeria’s high tax and regulatory burden.

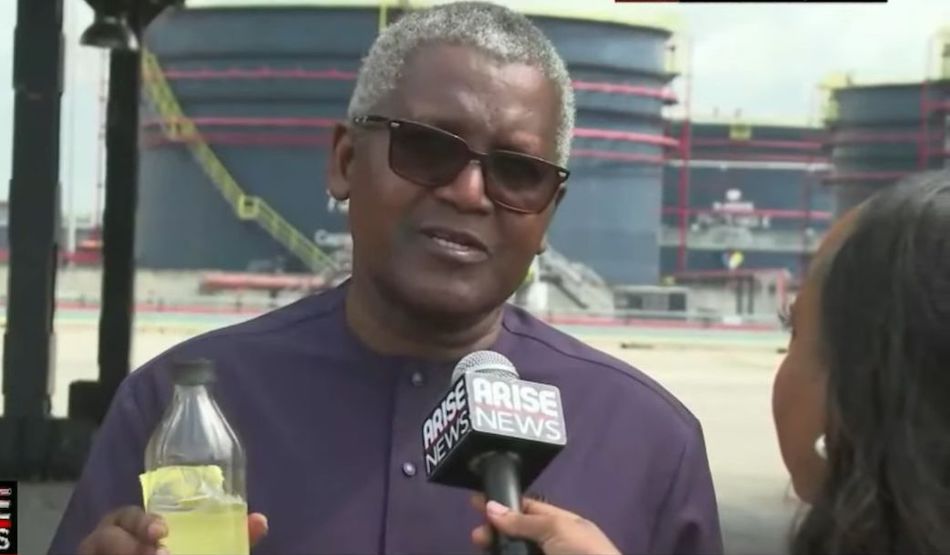

During a press conference with members of the press on Monday, exporting permits his company to avoid a variety of taxes that would dramatically increase production expenses at home.

“When you look at my invoice, the cement I export is cheaper than the one I’m selling domestically, because that’s how exports work… in export I’m saving a lot of money, I’m not paying 30% income tax, I’m not paying 2%, education, I’m not paying 1% health, I’m not paying 7.5% VAT, and I’m not paying 10% withholding tax.”

By eliminating these costs, the Nigerian billionaire noted that he would be able to price Nigerian cement competitively in global markets against producers from Turkey, Russia, and China.

In fact, Nigeria’s fiscal framework makes it cheaper to sell locally produced items overseas than at home, reflecting deeper structural flaws in the economy.

“So when you reduce all these taxes, I can afford to go and compete with the international market, with the likes of Turkey, Russia, and China,” he stated.

The implication is clear: Nigerian consumers bear the cost of high taxes, various levies, and regulatory inefficiency. While local production is sometimes marketed as a remedy to high pricing, Dangote’s experience demonstrates how policy decisions can undercut that goal.