Eight months after Danjuma Musa, a Kuda Bank customer, lost N877,000 to two unauthorised transactions on his account, the bank has yet to help him recover the funds.

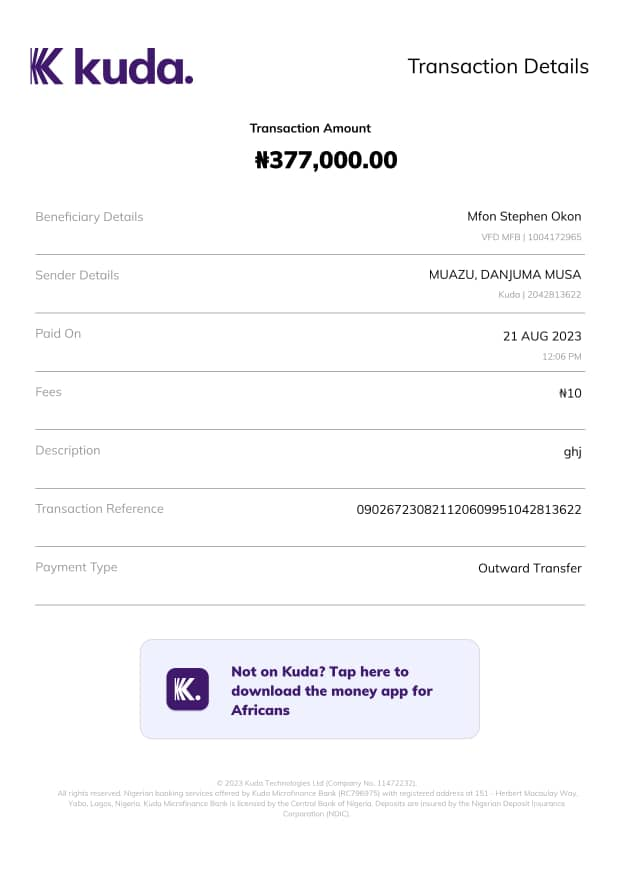

According to Musa, at 12 pm on August 21, 2023, he received a debit alert of N500,000 from Kuda. The funds were transferred to Zainab Akeem, a customer of Moniepoint with account number 1004172965.

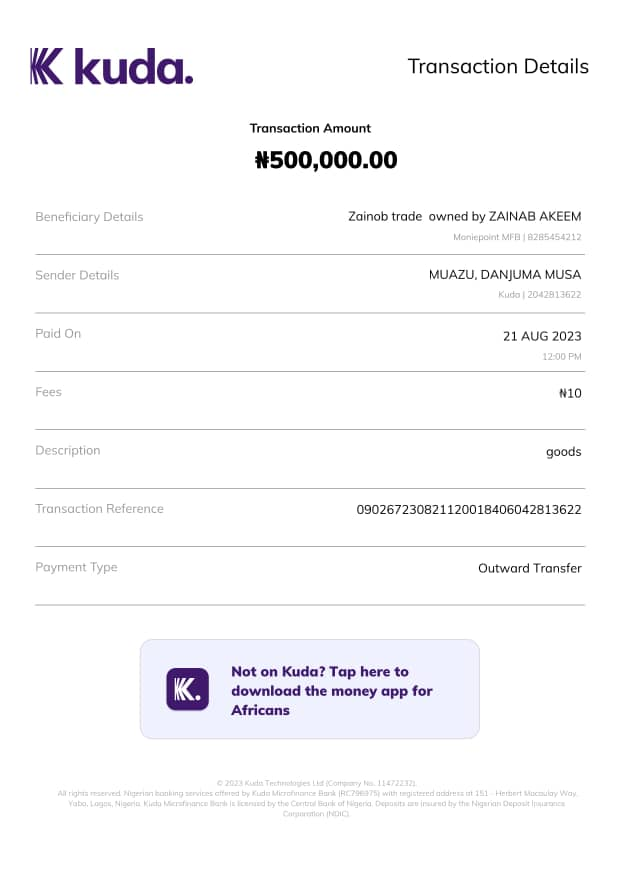

Six minutes later, he received another debit alert from Kuda. This time, N377,000 had been transferred to Mfon Stephen Okon, a VFD Microfinance Bank account with account number 8285454212.

He contacted Kuda Bank Care to file complaints and seek help recovering the funds. Unsatisfied with their response, he travelled from Ilorin to Kuda’s head office in Lagos.

“Immediately after receiving the alerts, I contacted Kuda. I even had to travel to Lagos from Ilorin. When I got there, I was told the beneficiaries had utilised the money and there was nothing they could do,” said Musa.

He returned to Lagos sad and dejected but continued to engage Kuda Bank to see if they could still render some help. However, the response remained the same.

“I have been engaging my bank since last year to inquire if they have any information from the beneficiaries’ banks or if a lien has been placed on their accounts, but there has been no positive response from them. It is saddening that there has been no positive feedback from them since last year,” Musa said.

He also tried to get a court order from a court in Abuja, but the court informed him that this was impossible.

“I was told they could not provide a court order unless the beneficiaries’ banks said there were funds in the accounts, because it was an online transaction,” Musa told FIJ.

On Tuesday, FIJ emailed Kuda Bank, VFD Microfinance Bank and Moniepoint. Kuda said they would respond within 24 hours but had not responded at press time.

VFD Microfinance Bank responded:

“We acknowledge and appreciate your work and its contribution to the society. However, VFD Microfinance Bank is not obligated to disclose confidential information about a customer or transactions to unauthorised parties except regulatory agencies.”

FIJ