The British energy giant, Shell, is concluding nearly a century of onshore oil and gas operations in Nigeria by selling its subsidiary, The Shell Petroleum Development Company of Nigeria Limited (SPDC), to the Renaissance consortium for a substantial $1.3 billion. This notable divestment signifies a strategic shift for Shell, as it aligns with the company’s intention to withdraw from onshore oil production in the Niger Delta.

The Renaissance consortium, a powerhouse comprising ND Western, Aradel Energy, First E&P, Waltersmith – all prominent local oil exploration and production companies – and the Swiss-based trading and investment company Petrolin, secured the deal. This acquisition underscores a changing landscape in Nigeria’s energy sector as Western companies, including Shell, strategically withdraw from onshore operations to focus on more lucrative offshore ventures.

The transaction, subject to approval by the Nigerian government, involves the transfer of responsibilities for dealing with spills, theft, and sabotage to the Renaissance consortium. Shell’s exit has prompted calls for accountability, with Nnimmo Bassey, Executive Director of the Health of Mother Earth Foundation, insisting that Shell must take full responsibility for the environmental impact caused during its tenure.

The five key figures leading the Renaissance consortium are notable players in the Nigerian energy scene:

1. Adegbite Falade

The driving force behind the Renaissance Consortium’s landmark acquisition is Adegbite Falade, the Chief Executive Officer of Niger Delta Exploration & Production (NDEP). A distinguished individual with a First Class B.Sc. in Electrical & Electronics Engineering from the University of Ibadan and an MBA from Warwick Business School, Falade brings over 14 years of senior executive experience in the oil, gas, power, and services sectors to the consortium.

Having previously served as the Managing Director and Group COO at OilServ Group in Port Harcourt, Falade’s expertise extends across engineering, operations, project execution, commercial endeavors, client and stakeholder management, as well as strategy and enterprise development. His strategic leadership and industry acumen position him as a key player in steering the Renaissance Consortium toward a prosperous future.

2. Eberechukwu Oji

At the helm of ND Western Limited is Eberechukwu Oji, the Managing Director/Chief Executive Officer since March 2020. Armed with over 25 years of experience in the oil and gas sector, Oji is a Fellow of the Nigerian Society of Engineers and a Chartered Engineer with The Council for the Regulation of Engineering in Nigeria (COREN).

Oji’s academic background includes a Master’s in Business Administration (MBA) from Warwick University, a Master’s in Technology (MTech) in Petroleum Engineering from Curtin University, and a Master’s in Engineering (MEng) in Electrical & Electronics Engineering. Prior to joining ND Western, Oji served as Chief Operating Officer (COO) at Neconde Energy Limited, overseeing exploration and production oil and gas accountability from reservoir to export point operations.

3. Ademola Adeyemi-Bero

Playing a pivotal role in the Renaissance Consortium, Ademola Adeyemi-Bero, the Managing Director of First E&P, brings a wealth of experience garnered over 20 years with Shell International. His diverse roles within Shell, including Business Director of Shell’s Nigeria Joint Venture and VP New Business, Africa within Shell International E&P, showcase a deep understanding of the oil and gas business across various functions.

Adeyemi-Bero’s journey includes roles such as General & Asset Management and Chief Technical roles across multiple countries. Co-founding FIRST E&P after joining BG Group, he possesses a sound understanding of the Nigerian oil and gas business environment, making him a valuable asset to the Renaissance Consortium.

4. Samuel Dossou-Aworet

Samuel Dossou-Aworet, the founder and chairman of the PETROLIN group, stands as a distinguished petroleum engineer and a highly respected businessman with over 40 years of experience. Born in Porto Novo, Benin, he established the PETROLIN group in 1992, operating in trading, exploration, and production across Central and West Africa, the Great Lakes region, and the Middle East.

Dossou-Aworet’s dynamic career includes serving as Chairman of the OPEC Board of Governors and acting as a Strategic Advisor to heads of state and international oil companies for over two decades. His influence extends to being the General Manager of Hydrocarbons in Gabon for more than 15 years, solidifying his position as a key figure in the Renaissance Consortium.

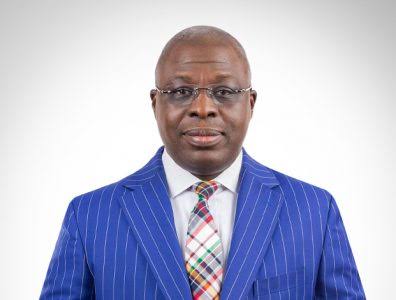

5. Alhaji Abdulrazaq Isa

Chairman and CEO of Waltersmith Petroman Oil Limited, Alhaji Abdulrazaq Isa Kutepa, brings over 30 years of experience to the Renaissance Consortium. Born in Lokoja, Nigeria, Abdulrazaq graduated from Ahmadu Bello University with a BSc (Hons) in Sociology.

His international exposure includes professional programs at Citibank Global Training School, Lee Kuan Yew School of Public Policy in the University of Singapore, and Cox School of Business, Southern Methodist University, Dallas, Texas. Abdulrazaq’s extensive experience in strategy, enterprise transformation, asset development, and project management positions him as a seasoned entrepreneur and a vital member of the Renaissance Consortium.

Responsibility Transfer and Legal Challenges

Renaissance is set to assume responsibility for addressing spills, theft, and sabotage, a role previously held by Shell. The energy giant has grappled with multiple compensation lawsuits in recent years due to damage resulting from spills in the Niger Delta.

Nnimmo Bassey, Executive Director of the Nigerian advocacy group Health of Mother Earth Foundation, emphasized, “Shell must own up to its responsibility.”

“This means full payment for the remediation and restoration of the polluted areas as well as reparations to the host communities. They cannot walk away from the virtually irreparable harm they have caused,” Bassey said in a statement.

Operational under Shell’s SPDC Limited, the company holds a 30% stake in the SPDC joint venture, overseeing 18 onshore and shallow water mining leases. As of the end of 2022, Shell’s resources within SPDC amounted to approximately 458 million barrels of oil equivalent.

It’s gathered that confirmation by Renaissance has been received for the sale, which is contingent upon approval from the Nigerian government.