In the imminent future, the federal government is poised to revolutionize transactions within the entire foreign exchange market.

Their primary aim is to effectively curb wide-scale arbitrage activities while also taking measures to penalize those who speculate on the naira.

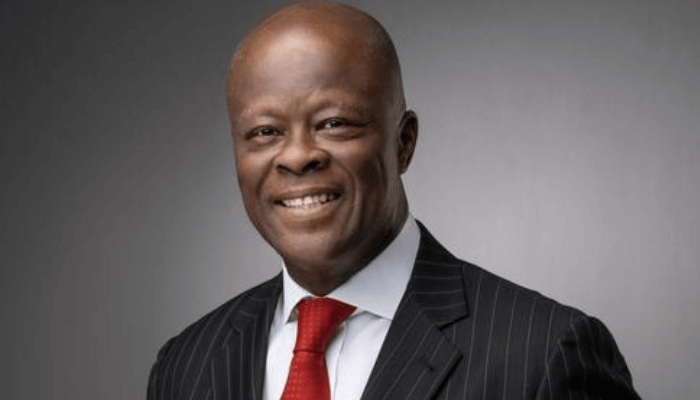

Wale Edun, who serves as both the Minister of Finance and the Coordinating Minister of the Economy, disclosed this progressive initiative during the inaugural panel session at the 29th Nigeria Economic Summit (#NES29).

Edun’s announcement followed closely on the heels of President Tinubu’s address to the attendees of the summit.

In his statement, President Tinubu conveyed his commitment to addressing liquidity issues within the foreign exchange market and pledged to resolve the existing backlog of transactions.

According to him, all dealings in the fx market, from the official to the money changers where huge arbitrage has consistently occurred, will be thoroughly monitored and offenders fished out and punished.

He also disclosed that the president signed two executive orders last week.

One of them is an executive order that allows forbearance for all the cash in the economy to come in and formally boost the money supply legally.

There’s another executive order that allows domestic issuance of foreign currency issues so that it will allow incentive to provide that foreign exchange for whatever source.

He said alongside this and part of a broader sort of review, there is a revamping of the foreign exchange market, which he said will be unfolded as time goes.

He admitted that Nigeria’s foreign exchange market is not functioning effectively due to illiquidity and that the government is prepared to do everything required to change the status quo.

“Foreign exchange market will simplified and reformed such that all legal and legitimate transactions will fall within the purview of the authorities and in the formal foreign exchange market. Anything outside that will be illegal, a criminal offence and will be punished,” Edun stated.

In his comment, Yemi Cardoso, Governor of the Central Bank of Nigeria (CBN) assured that the apex bank, going forward, will take its objective of price stability “very seriously indeed.”

He said the plan is to have a foreign market that is fit for purpose and works for everybody, which can be predictable and with no opacity.

“We are going to come out with an elegant document that will tell you the rules,” the governor assured.