By Bebigiby

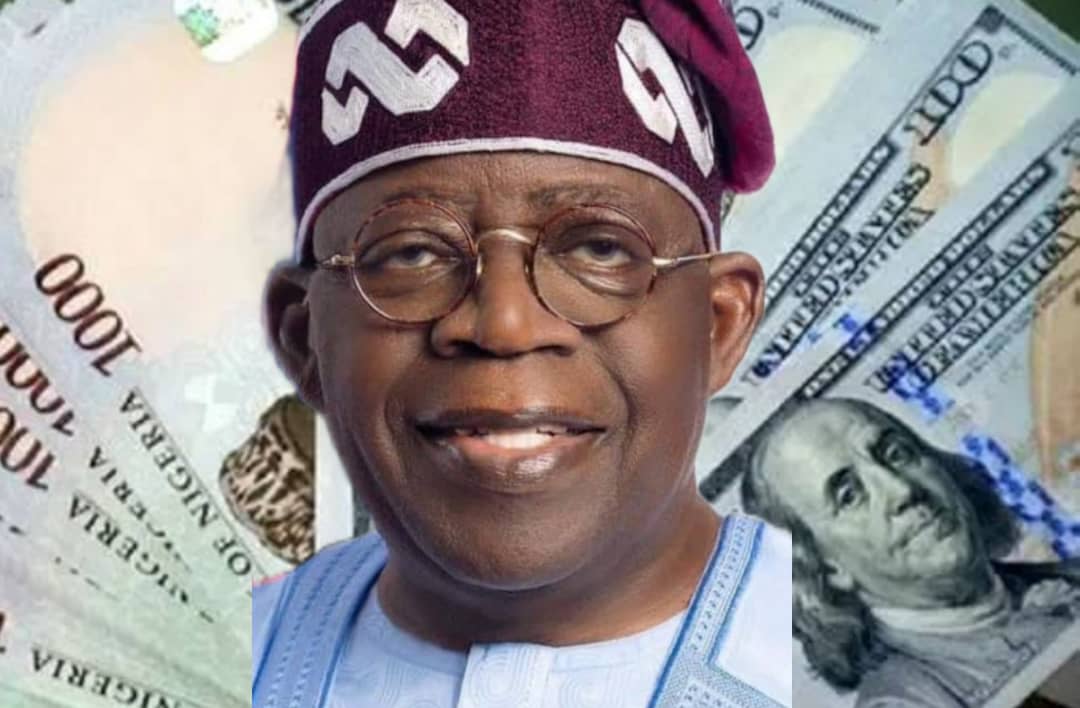

It was revealed yesterday that CBN directed Deposit Money Banks to remove the rate cap on the naira at the Investors and Exporters’ (I&E) Window of the foreign exchange market, to allow for a free float of the national currency against the dollar and other global currencies. The development came barely two weeks after Tinubu promised to unify the nation’s multiple exchange rates. Following the CBN announcement, the naira depreciated to over N700/dollar during trading on the I&E window today.

It is no longer news that Nigeria today is an import-dependent populous country with limited sources of foreign exchange. Since Nigeria economy majorly is import driven, the implication is that the demand for foreign exchange will always be higher than the supply. Under such circumstances, it is certain that allowing a free-float of the naira will have a negative impact on the currency, leading to poor exchange rate and inflation. While the inflation will impoverish the masses and lead to low demand for goods and services, the low Naira value will not lead to higher inflow of foreign currencies due to other factors such as security challenges, corruption, lack of electricity and other infrastructure deficits will limit the readiness of foreign investors to rush to Nigeria with euros and dollars. Above all, the country will pay more to service her dollar and euro-domiciled foreign loans.

It is important to note that many developed countries don’t allow a free-float of their currencies, rather, they use a combination of fiscal and monetary polices to control the exchange rate. For example, EU raises interest rates to combat inflation as against euro currency. After the EU central bank increased interest rates, the euro strengthened. Nigeria has no access to such instruments. This move by CBN and Tinubu’s APC government to free-float the naira will be another economic disaster (Post-Buhari era) if not properly managed.

The bottom line is that with the ill-advised free-float of the naira, inflation will increase, the people will be poorer and jobs will be lost. The government should have put in place moderate control mechanism before adopting a free-float of the currency, unfortunately this is Tinubu’s style of dishing out sensitive policies without proper planning as we all witnessed how he removed fuel subsidy during the presidential swearing-in ceremony. As I said in previous post, the illegitimate Tinubu’s APC government can not be trusted to offer any meaningful economic progress to Nigeria. This APC government definitely will continue the economic woes that plagued Buhari’s era. Nigerians who think that Tinubu will be different from Buhari are only been sentimental and naive to their own detriment. The person occupying the office of the president may be different but this is still the same APC government that brought Nigeria to it’s current economic sad state. Even Tinubu told Nigerians that “he will continue from where Buhari stopped”, it is foolish to expect anything different from his government. Nigerians must reject these ANTI-PEOPLE policies!

Bebigiby is a concerned Nigerian