European markets tumbled Monday and the euro hit a fresh 20-year low on growing fears about an energy crisis after Russia said it would not restart gas flows to the continent, while traders are also preparing for another interest rate hike this week, IgbereTV reports

The selling came after a mixed day in Asia, where the positive vibes from a US jobs report were offset by growing fears about the European outlook as well as Chinese Covid lockdowns and geopolitical tensions.

Paris, Frankfurt and London all sank sharply at the open after Russia’s Gazprom said it would not restart gas supplies to Europe, citing problems with a pipeline.

The announcement came the same day as the G7 nations said they would work to quickly implement a price cap on Russian oil exports, a move that would starve the Kremlin of critical revenue for its war effort.

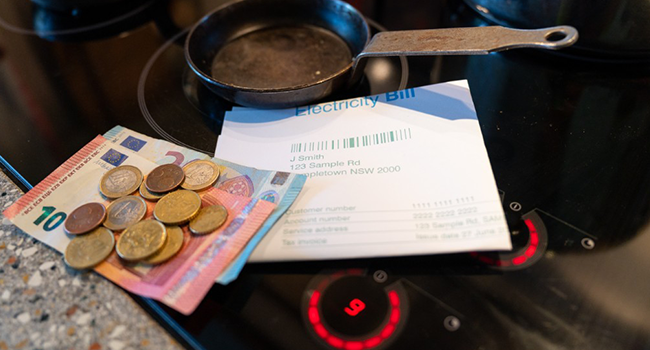

The news ramped up an energy crisis in the continent caused by sanctions on Moscow for its invasion of Ukraine in February.

It has sent shockwaves through the eurozone economy and fanned expectations it will sink into recession, while sending the euro tanking to a 20-year low against the dollar. The single currency hit a nadir of $0.9878 at one point.

“Russia’s ongoing weaponisation of energy supplies continues to increase downside risks for European economies and the euro,” said Lee Hardman, currency analyst at financial services group MUFG.

The issue has given the European Central Bank a huge headache. It is forced to lift interest rates as it struggles to contain runaway inflation.

Policymakers are due to announce a second straight lift at its meeting this week, with some observers betting on a 0.75 percentage point rise.

“The outlook is poor for Europe. It started to get choppy at the tail end of last week, and it is almost certainly going to get worse,” Gordon Shannon, of TwentyFour Asset Management, said.

“The ECB had only just started to catch up with the Fed in terms of hiking rates, but if we are going into a prolonged recession, I think this slows down their attempts