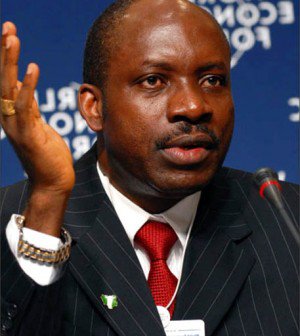

A former governor of the Central Bank of Nigeria (CBN), Prof Chukwuma Soludo, has revealed how Nigeria’s economy got into recession.

He attributed the economic woes facing Nigeria to the wrong choice of economic policies by former president, Goodluck Jonathan.

Soludo disclosed this while speaking at an international conference organised by the Department of Business Administration of the Nnamdi Azikiwe University (UNIZIK) in Awka, Anambra State.

According to Soludo, the recession the country was facing was as a result of what he termed “bad habit of borrowing” at a period the country was in boom.

He blamed the past administration for plunging the economy into a glitch, saying the government did not act on time to save the situation.

Soludo also criticised the Treasury Single Account (TSA) policy, which, he said, stifled the economy further because it channelled public sector funds to the CBN.

He said, “Huge spending by government was one of the ways of solving the economic problem, but two wrong steps by the current government ruined that opportunity. They brought in the TSA and channelled funds into one account that did not allow spending. They also fixed the price of foreign exchange. These are things you do not do when a country is in economic crisis.”

He said the recession happened because the Goodluck Jonathan administration failed to save earnings from crude oil sale when there was unprecedented boom in oil prices.

He said, “Poor ideas transcended over superior ideas, and we went into recession which was slightly avoidable. That is why academics must be alive to their responsibility of nudging us to reality. If you borrow at a time of boom, what will you do in a time of lack? Even my grandmother in the village knows this.

“At the same time, when we had boom, we had unprecedented unemployment. The problem with Nigeria’s policymakers is that once oil goes up, we take it that it will remain so, and we continue to spend. But once there is a shock and oil prices go down, we just think it is temporary and we start borrowing. Nigeria can be fixed, and what it takes to fix Nigeria is not rocket science.”

He also called for fiscal federalism to help the states and local governments live beyond “running to the centre for their sustainability”.