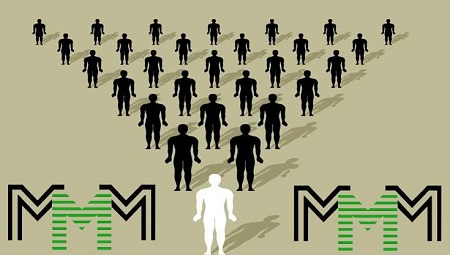

In spite of the bitter experience that millions of Nigerians have had since the foremost Ponzi scheme in the country, MMM, pulled a break on its operation last December, similar schemes are springing up and many Nigerians are investing in them.

Nigeria’s public financial and anti-graft institutions, including the Central Bank of Nigeria, Securities and Exchange Commission, SEC, Nigerian Deposit Insurance Corporation, NDIC, and Economic and Financial Crimes Commission, EFCC, have repeatedly warned that the schemes are fraudulent and that those investing in them may lose their money.

The NDIC recently said an estimated three million Nigerians lost N18billion when MMM suspended payment to investors last December.

Operators of MMM later claimed the suspension was because its system was “experiencing heavy workload”.

On January 13, the scheme however resumed operations, 24 hours before the date it had promised to do so.

But the scheme has been tainted by the un-forewarned suspension of operations and many other complaints, with millions of investors not able to access payment and few new ones joining since then.

According to Premium Times, some checks have revealed that its official website, www.mmm-nigeria.net, now has online consultants taking questions from visitors.

Amy, one of the online consultants, disputed the NDIC claim of heavy financial loss by investors in the scheme.

She told Premium Times that MMM Nigeria only engages in “member to member transactions” and does not make profit from its operation or take money from participants.

Amy disclosed that the scheme had introduced new measures to avert the challenges that last year forced it to temporarily halt its operation. The new measures include placement of limit on payments to 2016 investors, who are referred to as ‘Mavro-2016’.

“A special limit for Mavro-2016 payments has been introduced. This limit was determined in such a way that GHs for Mavro-2016 won’t create any additional burden on the Community and won’t affect its sustainability. According to this limit, members get a part of their Mavros-2016 every day.

“Members who can request help in Mavros-2016 are selected randomly. Therefore, if you want to withdraw your Mavros-2016, check your PO regularly. Your turn may come. Besides that, MMM is developing additional tools that will allow it to intensify payments for Mavros-2016,” the consultant stated.

However, further checks revealed that many 2016 investors are still in the dark over payment issues.

Rapulu Ifebe, who invested N200,000 regretted not requesting for help when his deposit had appreciated to N450,000. He was waiting to get to N600,000 when the scheme placed the ban on payments last December. He said he has since not been able to make any recovery.

“Forget all those stories. I have not been paid, but I hope to get paid for real”, Mr. Ifebe said.

Pascal Onuorah said he invested N97,000.

“When MMM resumed in January, I was paired to receive N37,000 the day after. The two people I was paired with had to pay N17,000 and N20,000 to make up the N37,000, but only one person paid N17,000.

“Since then, I have not been paired for payment on my 2016 pledge and I have forgotten about that. I only get paid for investments I made in 2017 on the scheme”, Mr. Onuorah said.

Chinenye Nwosu, who refused to disclose how much she invested in 2016, said she has moved on from the experience.

“I heard that the scheme is now paying 2016 investors gradually but I have not really checked to see if I am paired because I have moved on with my life”, she said.

In spite of the financial losses suffered by millions of MMM investors, similar new schemes are springing up and attracting patronage by Nigerians.