Mavrodi Mondial Moneybox, the Ponzi scheme popularly known as MMM, sent its participants into panic last month when it announced that all accounts used by Nigerians had been frozen.

Precisely on Tuesday December 13 2016, one day after the Eid-el-Maulud holiday, Nigerians woke up to the news which many MMM enthusiasts, who fondly call themselves Mavrodians, received with mixed feelings.

MMM had sent out the unexpected circular to all Nigerian users explaining why accounts will remain frozen for a period of 30 days.

The circular urged participants to be calm and unperturbed, saying the development was to help prevent any problems in transactions, among other reasons, during the New Year season.

With the duration expected to lapse on or before January 13, 2017, investors are anxiously looking forward to mid-January, with the hope that they finally will be able to have access to their accounts once again.

But while some participants say they believe the accounts would be reopened, others have remained in a worrying state, expressing doubts about the assurance given by MMM.

“My brother, I don’t sleep well these days. I cannot wait for middle of this month to hear and see the good news,” said a respondent who wishes to be identified only as Chuks.

“I blame myself for not totally resisting the temptation because I put money just 4 days before MMM froze accounts.

“My friends have been pledging, putting money and getting 30 per cent. Since it wasn’t hearsay, I eventually decided to give it a try with N500,000.

“My money is hanging now and I just want to get it back. I did for two weeks, so obviously my interest and profit is due for collection. Let MMM please unfreeze the accounts; I know millions too are waiting for that day.”

Speaking with Daily Post, another MMM investor, Toyin, said that she was confident the scheme would bounce back.

The self-employed lady in her early thirties further lectured our correspondent on why accounts were frozen.

“The December period is when many investors take their money and this would affect the aim of MMM which is to put money in people’s hands.

“Assuming the accounts were left open, 70 percent of people would have cashed out. The effect is that when people seek assistance, they will not get money in 9, 10 days, unlike normal circumstance when you can get within 48 hours.

“MMM foresaw this and from experience, they know that pledges reduces during Yuletide. It was a timely decision that Nigerians will still appreciate.”

On how the popular scheme works, Toyin said participants can register themselves or have someone do so for them.

“If you come to me that you want to invest and decide to pledge N100,000, I will help spread it. An amount can be shared into as many as 4 places or more, depending on what the computer generates.

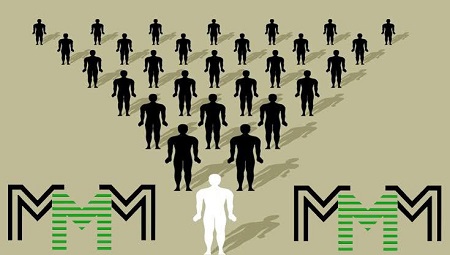

“I pay on your behalf to those accounts and then inform the owners of your payment; I also send proof. After this process, I continue to monitor. This of course is why people like me get 5 percent referral bonus. I have 13 participants under me.

“Those who have thousands of participants under them are the Guiders. They are the MMM multi-millionaires; the ones you see buying cars, houses and living large.

“What I noticed is that many actually prefer to give money to others to invest because they don’t want to go through the stress of staying online or making payments. Theirs is just to see credit alert.”

Meanwhile, top MMM Nigerian guiders have continued to assure Nigerians that there is no cause for alarm.

While one, a self-styled Nigerian pastor, Ernest Chigozie Mbanefo, boasted that MMM will run smoothly until Jesus Christ comes, another threw a lavish end of the year party in Lagos, apparently to boost investors’ confidence that all is well.

Similarly, MMM founder Sergey Mavrodi, a fortnight ago warned critics to stop castigating the scheme.

“Leave MMM alone and let us work. Nothing has collapsed, and MMM will perfectly resume its work in January. We can change the world!” he asserted.

But President of Omega Fire Ministry, Apostle John Suleman, predicted doom for the Ponzi scheme in his prophecies for the year 2017, concluding that money-doubler will crash.

While investors and Nigerians await the next news about MMM, the arguable fact is that the current recession in the country helped to make the scheme popular in Nigeria.

But for MMM, the freezing of accounts in Nigeria does not stop it from launching in other countries as it recently did in Kenya and Ghana.

During the launch in Kenya, MMM noted that it is

“a community of ordinary people, selflessly helping each other. The goal here is not the money. The goal is to destroy the world’s unjust financial system. Financial Apocalypse! Before you join, be sure to get acquainted with our IDEOLOGY!”

Before Nigeria, MMM had taken its message to other African countries like South Africa and Zimbabwe. In 2016 though, South Africans who took part in the scheme had their accounts frozen and up till now, it has remained that way.

MMM was founded by Mavrodi, former Russian politician, who went on the run when the original MMM collapsed in the late 1990s. By different estimates, from 5 to 40 million people lost up to $10 billion. The exact figures are not known even to the owners.